georgia property tax exemption for certain charities measure

4000 off county bond taxes. Property Tax Exemption for Certain Charities Measure.

2020 2021 State Executive Orders Covid 19 Resources For State Leaders

Heres a closer look at.

. GA Code 48-5-41 2014 a The following property shall be exempt from all ad. Land Held for Future Charitable Use Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. Any Georgia resident can be granted a 2000 exemption from county and school taxes.

The Georgia Charitable Institutions Tax Exemptions Referendum also known as Referendum C was on the November 7 2006 ballot in Georgia as a legislatively referred state. The foundation applied for an exemption from property tax as an institution of purely public charity under OCGA. Georgia Ballot Measure - Referendum A.

Expand an exemption for. People who are 65 or older can get a 4000 exemption. Property Tax Exemption for Certain Charities Measure.

September 19 2022. An organization engaged primarily in charitable activities may be eligible for a local property tax exemption. Sept 28 2020.

3 2020 General Outcome. HB 498 - Proposition 2. Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax exemptions for agricultural.

100 disabled persons of any age can apply for this exemption. The Athens-Clarke County Board of Tax. The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan.

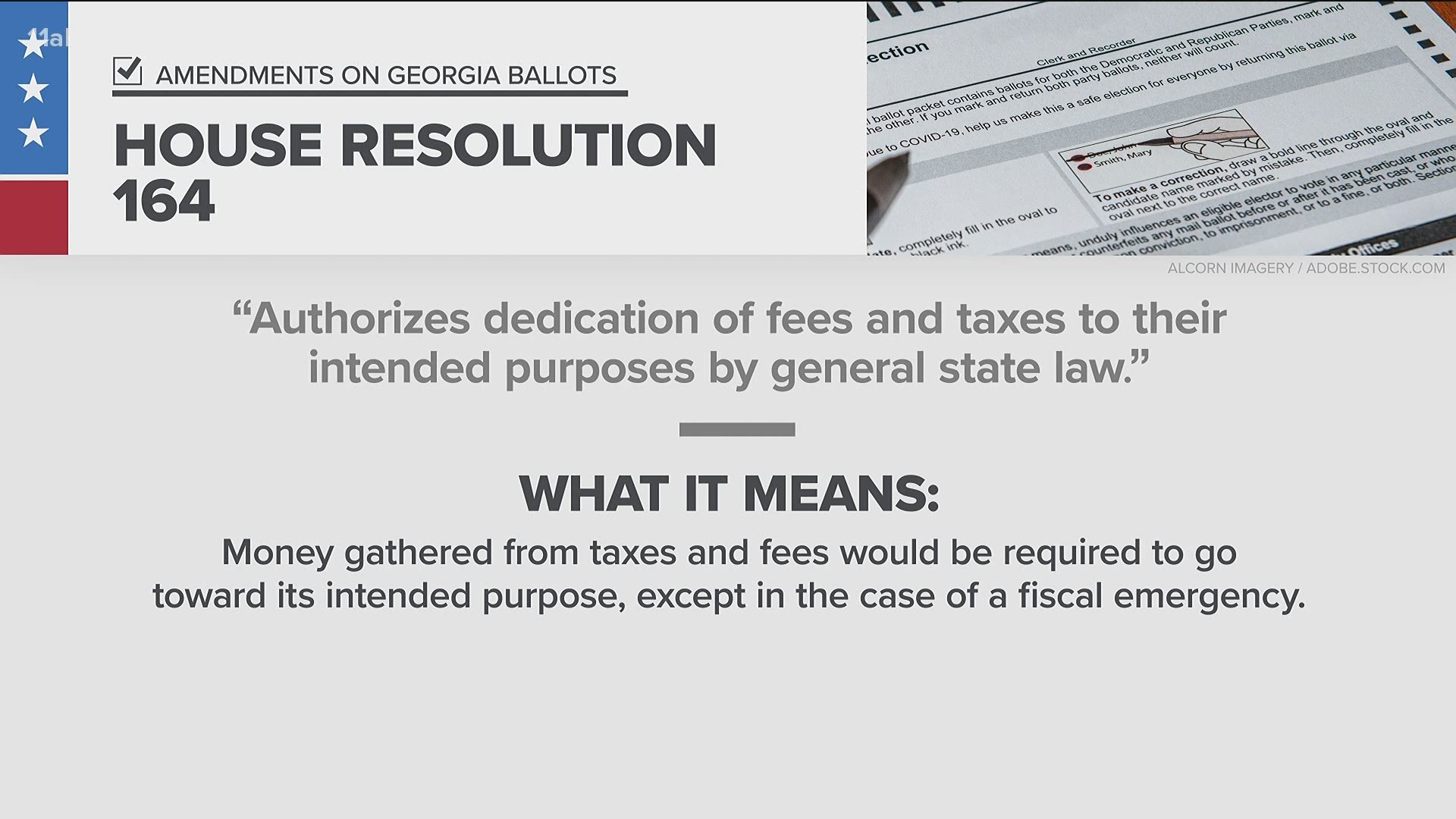

1 The property is committed to and held in. Georgia voters in November will help decide the fate of government fees and lawsuits as well as property tax breaks for certain charities. Individuals 65 Years of Age and Older.

Additionally a corporation may be eligible for a local property tax.

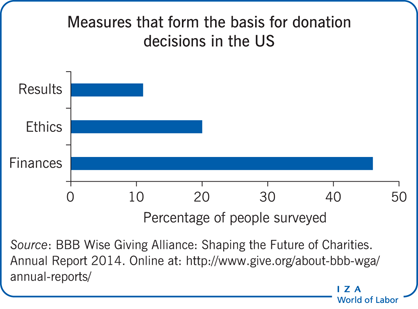

Iza World Of Labor Are Overhead Costs A Good Guide For Charitable Giving

Amazon Com Stacey Abrams Georgia Governor Race Red White Blue Yard Sign With Metal H Stake Patio Lawn Garden

2020 Election What Amendments On The Georgia Ballot 11alive Com

Patient Financial Assistance Programs A Path To Affordability Or A Barrier To Accessible Cancer Care Journal Of Clinical Oncology

Two Types Of Charitable Trusts You Should Know About Carr Riggs Ingram Cpas And Advisors

Indirect Tax Kpmg United States

Learn More About Georgia Property Tax H R Block

Georgia 2020 Ballot Measures Ballotpedia

Proposition 19 Which Modifies Prop 13 Property Tax Breaks Maintaining Its Lead In California

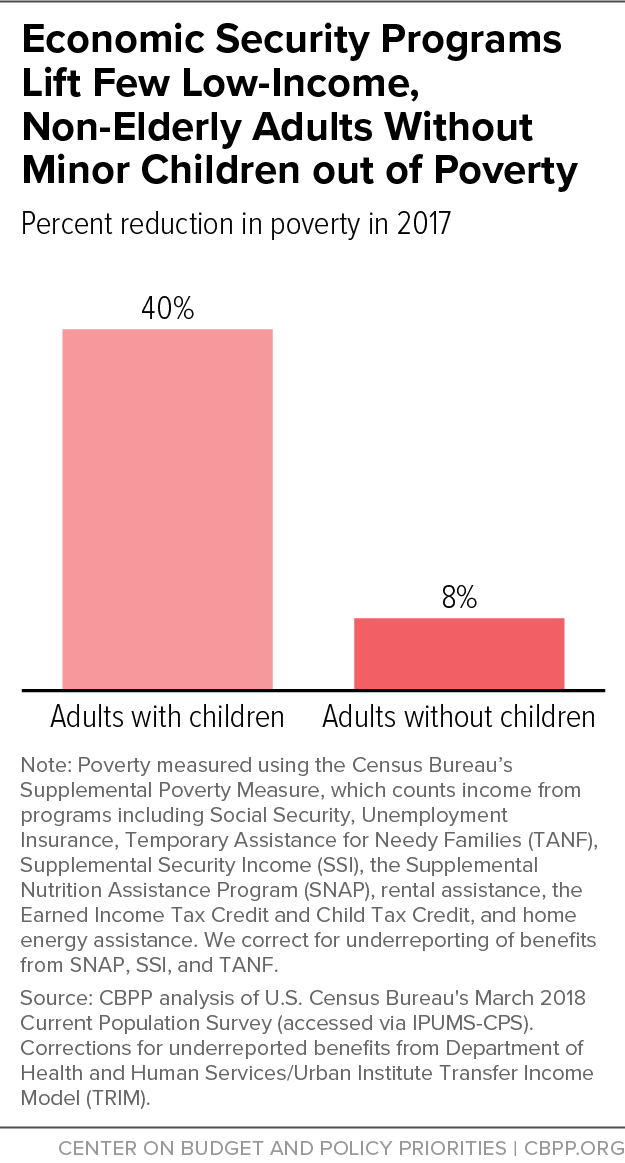

A Frayed And Fragmented System Of Supports For Low Income Adults Without Minor Children Center On Budget And Policy Priorities

Publication 225 2021 Farmer S Tax Guide Internal Revenue Service

Sales Taxes In The United States Wikipedia

Doing Business In The United States Federal Tax Issues Pwc

How Is Tax Liability Calculated Common Tax Questions Answered

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Dentons Charities And Nonprofit Taxation

Iatse Local 479 Home Dedicated To The Representation Of Every Worker Employed In Our Crafts

94 Of Firms Plan To Maintain Or Heighten Charitable Giving

Georgia Referendum A Property Tax Exemption For Certain Charities Measure 2020 Ballotpedia